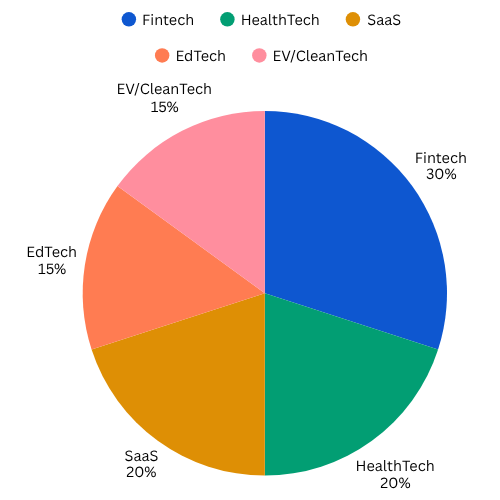

We help investors participate in early-stage companies with disruptive ideas and scalable business models. Backed by due diligence, our platform identifies startups across high-growth sectors like fintech, healthtech, edtech, and clean energy.

Startup investments in India follow the guidelines of the Companies Act, FEMA, and DPIIT startup recognition norms. Angel tax exemptions apply to registered startups.

India had over 1,17,000 DPIIT-recognized startups in 2024. Startup funding crossed $14 billion that year despite macro headwinds (Source: Inc42, DPIIT).

Angel investors, early-stage venture capitalists, and those seeking high-risk, high-reward exposure.