NCDs are fixed-income instruments that offer predictable, periodic returns. These debt securities are issued by corporates to raise capital and are an attractive option for conservative investors.

NCDs are regulated under the Companies Act and SEBI (Issue and Listing of Non-Convertible Securities) Regulations, 2021. Investors must assess credit ratings and liquidity risks.

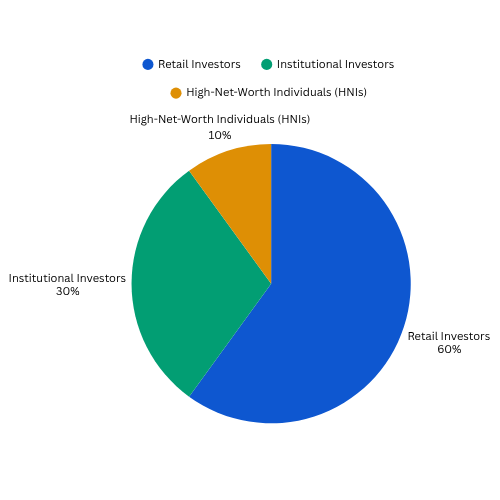

As of 2024, the Indian listed NCD market crossed ₹4 lakh crore, with rising retail participation (Source: NSE).

Risk-averse investors such as retirees or fixed-income seekers looking for reliable returns.