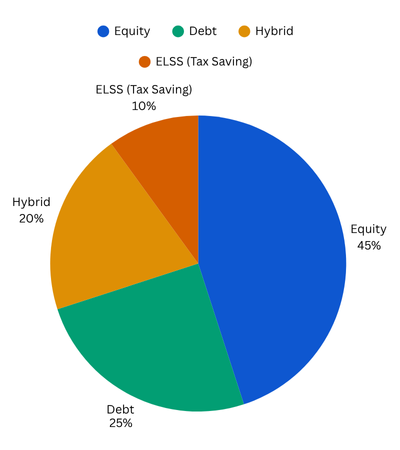

We offer a wide range of mutual fund options designed to match your financial goals and risk appetite. Whether you're looking for consistent returns, long-term capital growth, or tax-saving instruments, our experts help you select the right funds.

All mutual fund offerings are SEBI-regulated. Returns are subject to market risks. Investors must complete KYC and risk profiling before investing.

As of FY 2024-25, India’s mutual fund industry AUM crossed ₹53 lakh crore, with SIP contributions averaging ₹19,000 crore/month (Source: AMFI).

Ideal for new investors, salaried professionals, and long-term savers looking for a simple, regulated way to build wealth.