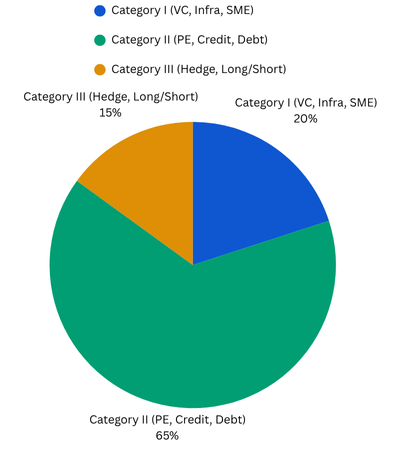

Our AIF offerings give qualified investors access to exclusive investment opportunities beyond traditional markets. These include private equity, venture capital, distressed assets, structured credit, and hedge strategies.

SEBI mandates a minimum ₹1 crore investment in AIFs. AIFs are governed by SEBI (Alternative Investment Funds) Regulations, 2012. Not meant for retail investors.

India’s AIF industry reached ₹10.6 lakh crore in commitments in 2024 (Source: SEBI Annual Report).

Accredited investors looking to diversify with sophisticated, high-growth investments.